[javascript protected email address]

Jump, London

Circa 1878

Sold

6½ inches high

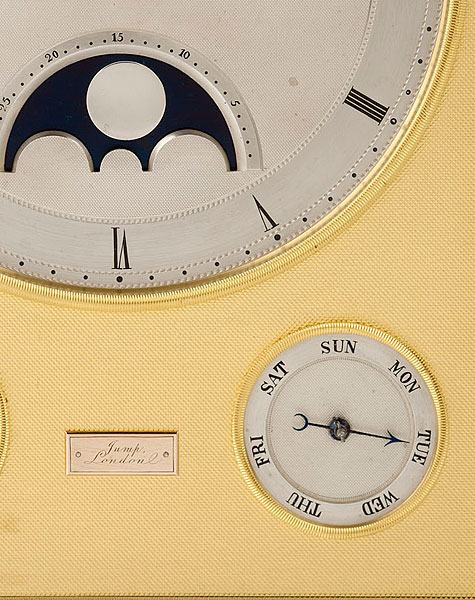

An important silver humpback carriage clock with day/date calendar and the original silver ratchet winding key, made for Francis Baring, 1st Baron Revelstoke. Signed JUMP LONDON Hallmarked London 1878 Case maker’s mark HH for Henry Holland DIAL The silver dial has a beautifully engine-turned centre with seconds ring and lunar aperture with blued steel heavens and silver moon discs. The burnished silver narrow chapter ring has Roman numerals and elegant gold Breguet-style hands. The gilt engine-turned surround is applied with a gold plaque signed Jump, London which is flanked by two engine-turned silver calendar dials for the date and day of the week. MOVEMENT The substantial 8-day duration movement has five conical-form brass pillars which are pinned at the front plate and secured with blued steel screws at the back plate. The going train comprising a spring barrel and chain fusee with maintaining power and all the wheels with five crossings. The train terminating with a large gilt-brass platform with top quality ratchet tooth jewelled lever escapement with cut bimetallic compensation balance with numerous solid gold timing screws. The backplate is engraved Jump London in the centre with winding and hand-set squares and further squares for the two calendar dials. CASE The well-proportioned solid silver humpback case is hallmarked for London 1878 with the casemaker’s stamp for Joseph and Henry Jump. The case is surmounted by a multi-link silver chain handle, the friction-fit front door has a bevelled glass whilst the rear door has a spring-loaded secret release button in the right rear bun foot; the door itself has shuttered winding holes for the wind and hand-set squares. The rear door and underside of the case are clearly hallmarked. Sold together with the original substantial silver Breguet-style double-ended ratchet key. PROVENANCE Edward Baring, 1st Baron Revelstoke of Membland, Devon (1828-1897) Thence to his 7th daughter; The Hon Susan Baring (1870-1961) married to Sir James Reid Bt. 1st. Baronet Reid of Ellon (1849-1923) Thence to their 2nd son; Admiral Sir John Peter Lorne Reid C.V.O. C.G.B. (1903-1973) m. Jean Dundas Thence to his daughter Lady Delia Montgomery née Reid – (b. 25 July 1935) the present owner and Great granddaughter of the original owner Edward Baring. - married to Sir Basil Henry David Montgomery, 9th Baronet Montgomery of Stanhope of Kinross House, Dundee. THE BARING FAMILY This clock was originally made for Edward Baring (13 April 1828 - 17 July 1897), 1st Baron Revelstoke (1885) and senior partner of Barings Bank. A brief history of the bank 1762–1890 Barings Bank was founded in 1762 as the John and Francis Baring Company by Francis Baring, with his older brother John as a mostly silent partner. They were sons of John (née Johan) Baring, wool trader of Exeter, born in Bremen, Germany. The company began in offices off Cheapside, but within a few years moved to larger quarters in Mincing Lane[3]. Barings gradually diversified from wool into many other commodities, providing financial services necessary for the rapid growth of international trade. By 1790, Barings had greatly expanded its resources, both through Francis'' efforts in London and by association with leading Amsterdam bankers Hope & Co. In 1793; the increased business necessitated a move to larger quarters in Devonshire Square. Francis and his family lived upstairs, above the offices. In 1800, John retired and the company was reorganized as Francis Baring and Co. Francis'' new partners were his eldest son Thomas (later to be Sir Thomas Baring, 2nd Baronet) and son-in-law Charles Wall. Then, in 1802, Barings and Hope were called on to facilitate the largest land purchase in history - the Louisiana Purchase. This was accomplished despite the fact that Britain was at war with France and the sale had the effect of financing Napoleon''s war effort. Technically, the United States did not purchase Louisiana from Napoleon, but from Barings and Hope. After a $3 million down payment in gold, the remainder of the purchase was made in U.S. bonds, which Napoleon sold to Barings at a discount of 87½ per $100. Francis'' second son Alexander, working for Hope & Co., made the arrangements in Paris with François Barbé-Marbois, Director of the Public Treasury. Alexander then sailed to the United States and back to pick up the bonds and deliver them to France. In 1803, Francis began to withdraw from active management, bringing in Thomas'' younger brothers Alexander and Henry to become partners in 1804. The new partnership was called Baring Brothers & Co., which it remained until 1890. The offspring of these three brothers became the future generations of Barings leadership. In 1806, the company relocated to 8 Bishopsgate, where they stayed for the remaining life of the company, the property undergoing several expansions and refurbishments, and finally putting up a new high-rise building in 1981. A fall off in business and a lack of good leadership in 1820s caused Barings to cede its dominance in the City of London to the rival firm of N M Rothschild & Sons. Barings remained a powerful firm, however, and in the 1830s the leadership of new American partner Joshua Bates, together with Thomas Baring, son of Sir Thomas Baring, 2nd Baronet, began a turnaround. Bates advocated a shift in Barings'' efforts from Europe to the Americas, believing that greater opportunity lay in the West. In 1832, a Barings office was established in Liverpool specifically to capitalize on new North American opportunities. In 1843, Barings became exclusive agent to the U.S. government, a position they held until 1871. Barings was next appointed by Sir Robert Peel with supplying ''Indian corn'' or Maize to Ireland as a famine relief foodstuff between November 1845 and July 1846 following the failure of the staple potato crop. The company declined to act beyond 1846 when the government instructed them to restrict purchases to within the United Kingdom. Baring Brothers refused any commission for work performed in the cause of Famine relief. Their position as prime purchasers of Indian corn was assumed by Erichson, a corn factor of Fenchurch St, London. In 1851, Baring and Bates brought in another American, Russell Sturgis as partner. Despite the embarrassment to his partners caused by his sympathies for the South in the American Civil War, Sturgis proved a capable banker and, following the death of Bates in 1864, gradually assumed a leadership role in the firm. In the 1850s and 1860s, commercial credit business provided the firm with its ''bread and butter'' income. Thomas Baring''s nephew Edward, son of Henry Baring, became a partner in 1856. By the 1870s, under the emerging leadership of "Ned" Baring, later the 1st Baron Revelstoke, Barings increasingly involved in international securities, especially from the United States, Canada, and Argentina. Barings cautiously and successfully ventured into the North American railroad boom following the Civil War. A new railroad town in British Columbia was renamed Revelstoke, in honor of the leading partner of the bank that enabled the completion of the Canadian-Pacific Railway. Later in the 1880s, daring efforts in underwriting got the firm into serious trouble through overexposure to Argentine and Uruguayan debt. In 1890, Argentine president Miguel Juárez Celman was forced to resign following the Revolución del Parque, and the country was close to defaulting on its debt payments. This crisis finally exposed the vulnerability of Barings position. Lacking sufficient reserves to support the Argentine bonds until they got their house in order, the bank had to be rescued by a consortium organized by the governor of the Bank of England, William Lidderdale. The resulting turmoil in financial markets became known as the Panic of 1890. 1891–1929 Although the rescue avoided what could have been a worldwide financial collapse, Barings never regained its dominant position. A limited liability company - Baring Brothers & Co., Ltd. - was formed, to which the viable business of the old partnership was transferred. The assets of the old house and several partners were taken over and liquidated to repay the rescue consortium, with guarantees provided by the Bank of England. Lord Revelstoke and others lost their partnerships along with their personal fortunes, which were pledged to support the bank. It was almost ten years before the debts were paid off. Revelstoke did not live to see this accomplished, dying in 1892. Barings did not return to issuing on a substantial scale until 1900, concentrating on securities in the United States and Argentina. Its new, restrained manner, under the leadership of Edward''s son John, made Barings a more appropriate representative of the British establishment. The company established ties with King George V, beginning a close relationship with the British monarchy that would endure until Barings'' final collapse in 1995. (Diana, Princess of Wales, was a great-granddaughter of one of the Barings family.) The descendants of five of the branches of the Baring family tree were elevated to the peerage, with the titles Baron Revelstoke, Earl of Northbrook, Baron Ashburton, Baron Howick of Glendale and Earl of Cromer. The company''s restraint during this period would cost it its pre-eminence in the world of finance, but would later pay dividends when its refusal to take a chance on financing Germany''s recovery from World War I saved it the painful losses experienced by other British banks at the onset of the Great Depression. During the Second World War, the British government used Barings to liquidate assets in the United States and elsewhere to help finance the war effort. After the war, Barings was overtaken in size and influence by other banking houses, but remained an important player in the market, until 1995. THE BARING JUMP CLOCKS The present recently discovered Jump, hallmarked 1878, is the earliest recorded example from a very small group of humpback silver and shagreen carriage clocks made by the firm between 1878 and 1906. It has been long understood that four examples of Jump’s humpback clocks were ordered by the Baring Bank partners Barons Revelstoke, Northbrook, Ashburton & Cromer. But until the present example appeared on the market the only other Baring clock to have come to light was the one made for the 4th Lord Ashburton. That example, dated 1883, was a silver humpback perpetual calendar carriage clock, which was sold at Sotheby’s 12 years ago (17/12/98, lot 204) for £100,000. Until the recent appearance of the present example it was presumed that the Ashburton Jump was the company’s very first silver humpback carriage clock. In 1878, Lord Revelstoke was the Bank’s Senior Partner and as such it would seem wholly appropriate that he should have been the recipient of the first of the four Baring Jump clocks. HENRY HOLLAND, SILVERSMITH The Directory of Gold & Silversmiths, John Culme, p. 235 describes the firm; This important firm of manufacturing silversmiths was established, probably in 1838, by Henry Holland at 13 Lower Smith Street, Northampton Square, Clerkenwell. Clerkenwell was the centre for artisans in London and in particular it was the hub of the clockmaking industry in the 19th century. Over the ensuing decades Henry Holland made silver for many famous companies including Hunt & Roskell, Garrard & Co. & Goldsmiths & Silversmiths. The Revelstoke Jump is dated 1878 with the stamp for Henry Holland. Later the same year Holland took on James Slater as his junior partner and then the following year he took on James Aldwinkle. In 1883 the company moved to larger premises and the partners were ‘recorded’. The Ashburton Jump, dated 1883 has the stamp JA-JS for John Aldwinkle and James Slater. THE JUMP FAMILY Richard Huyton Jump was born in 1785 and joined the workshop of Benjamin Louis Vulliamy in 1812. Two of his three sons, Richard and Joseph were apprenticed to B. L. Vulliamy in 1825 and 1827. At this time Sylvain Mairet, a master clockmaker who served his apprenticeship under Abraham Louis Breguet, was working for Vulliamy and would have met and known the two Jump brothers. Perhaps he introduced them to James Ferguson Cole and they must surely have discussed the wonderful hump back clocks made by Cole and Mairet''s former master Breguet. Vulliamy died in 1854 and in 1855 Joseph Jump and a third brother, Alfred, set up their own business as successors to Vulliamy at 1a Old Bond Street. Sometime later Joseph''s son, Henry, joined his father and uncle. Alfred died in 1872 and Joseph and Henry worked alone until they were joined by Henry''s son, Henry Percival, in 1875. In 1880 the firm moved to 55 Pall Mall. In 1897 Henry’s second son, Arthur Huyton, joined the firm and the name was changed to Jump & Sons. The following year, 1898, they moved to 93 Mount Street and in November 1910 Jump & Sons were awarded the Royal Warrant. They remained in Mount Street until the firm ceased trading in 1934. THE HUMP BACK CLOCK The hump back clocks made by Joseph Jump and his descendants were inspired by the identically shaped clocks produced by Abraham Louis Breguet and James Ferguson Cole. Breguet made his first carriage clocks from about 1795, one of the earliest having been made especially for Napoleon Bonaparte. His earliest examples were cased in gilt-brass architectural cases with pilasters and elaborate capitals. However, for his very highest quality carriage clocks, Breguet encased them in silver hump back cases with multi-stranded silver chain carrying handles. These clocks dating to between 1812 and about 1828 were made to exacting standards and included all the complications a traveller required. They are rightly considered to be some of Breguet''s finest timepieces, costing some eight times more than a silver Souscription watch of the period. The late Queen Mother owned one of the finest examples of Breguet’s hump back carriage clocks; the silver hump back case had a typical chain link handle whilst the movement had tourbillion escapement and grande sonnerie strike with minute repeat, perpetual calendar – and alarm! Until she died the clock sat on a mantelpiece in her bathroom. Much admired in England throughout the 19th century, the elegant style and design of these silver cased hump-back clocks was later continued by the London firms of Jump and Nicole Nielsen, both producing very limited numbers of exquisite hump back travelling timepieces.